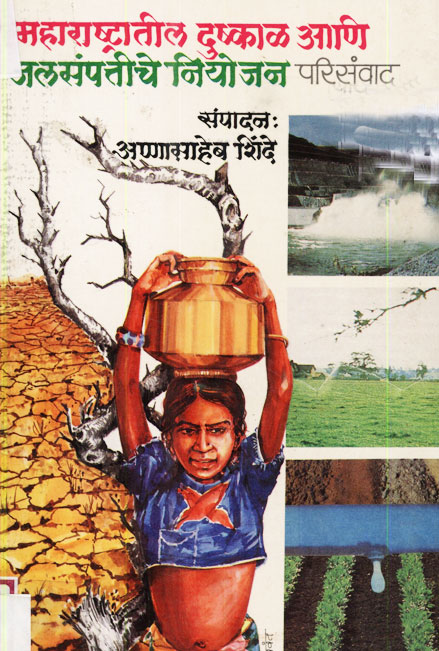

Agriculture in India has come a long way from the days of subsistence farming, helplessly dependent on the vagaries of nature. There are today visible signs of a break-through in this area brought about by adoption of modern techniques of cultivation, use of high-yielding varieties of seeds, fertilizers and pesticides and assured availability of water. I am aware that we have still miles to go before we succeed in making surplus farming a reality for the millions of small farmers, particularly in the dry farming areas, but the encouraging signs of our progress are definitely discernible. Modern farming, however, presumes larger and costlier inputs and unless we encourage and assist the farmers to make these heavy investments we will not be able to force the pace of change in agriculture. Thus, the key to a break-through in agriculture, which is an essential part of the programme of Garibi Hatao, is an assured and ample supply of credit for production and investment for farmers who, until fairly recently, were in this matter amongst the relatively under-privileged sections of the public.

Till the recent entry of commercial banks into agricultural financing, the only organised credit agencies for farmers were their cooperatives. There are today over one lakh and sixty thousand primary credit societies of farmers, but their total membership, not all of which is of actual borrowers, is only 30 million. Besides, in many cases, even the actual borrowers receive only a fraction of their actual credit needs. Also, the spread of effective cooperative coverage is very uneven, and there are some States which have large areas quite neglected or only inadequately covered. Even in areas where cooperative coverage is good, weaknesses are developing, especially by reason of overdues. The need for accelerated rehabilitation and development of cooperative banks and other societies in almost all parts of the country has, therefore, assumed critical urgency. Viewed against the background of the increased cost of modernised farming, the low figure of average cooperative loaning, which reflects the general weakness of the cooperative movement, must cause us grave concern. The lending techniques of the primary cooperatives were originally centered on security, and a more development-oriented outlook is still, in many cases, called for.